Achieve Financial Freedom

We take care of you so you can take care of others.

Save up to $8,000 per year and 5 years of repayment on personal and student debt

Below market interest rates - up to 70%

See your savings in 60 seconds

Save up to $8,000 per year and 5 years of repayment on personal and student debt

Below market interest rates - up to 70%

See your savings in 60 seconds

Save up to $8,000 per year and 5 years of repayment on personal and student debt

Below market interest rates - up to 70%

See your savings in 60 seconds

See Your Savings in

60 Seconds

Let us be the financial experts, so you can focus on patients.

Plannery automatically assesses your financial health

We build a customized debt assistance plan in under 60 seconds.

Our team is available to guide you at every step

Personal Debt

Assistance

Offers 60% below market rates to pay off existing high interest credit card/personal debt.

Plannery pays off high interest credit cards and personal loans directly to the debtors.

Enroll in payroll deduction to simplify your loan payments.

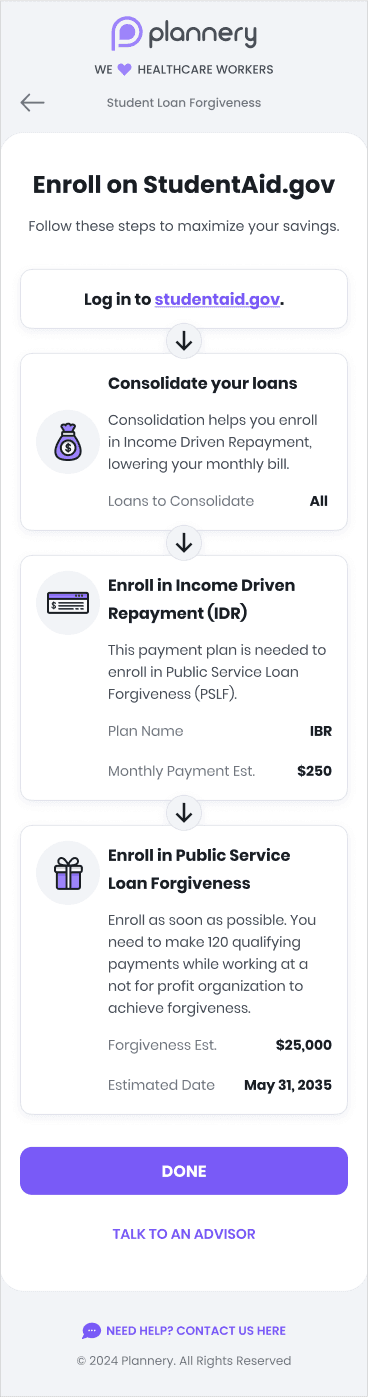

Student Loan

Assistance

Access government assistance and forgiveness, saving on average $64,000.

Receive a personalized enrollment guide.

Free consultation with an advisor, who can also enroll on your behalf.

See Your Savings in

60 Seconds

Let us be the financial experts, so you can focus on patients.

Plannery automatically assesses your financial health

We build a customized debt assistance plan in under 60 seconds.

Our team is available to guide you at every step

Personal Debt

Assistance

Offers 60% below market rates to pay off existing high interest credit card/personal debt.

Plannery pays off high interest credit cards and personal loans directly to the debtors.

Enroll in payroll deduction to simplify your loan payments.

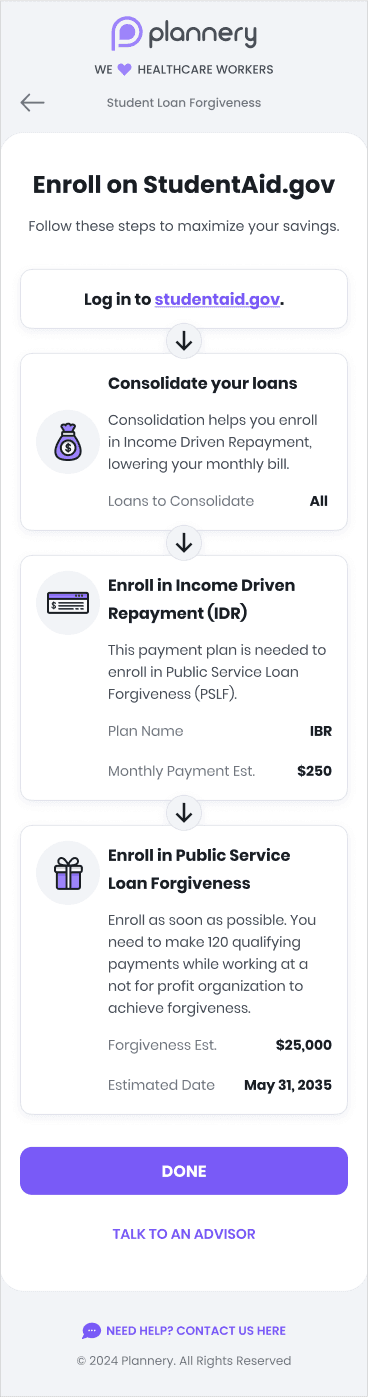

Student Loan

Assistance

Access government assistance and forgiveness, saving on average $64,000.

Receive a personalized enrollment guide.

Free consultation with an advisor, who can also enroll on your behalf.

See Your Savings in

60 Seconds

Let us be the financial experts, so you can focus on patients.

Plannery automatically assesses your financial health

We build a customized debt assistance plan in under 60 seconds.

Our team is available to guide you at every step

Personal Debt

Assistance

Offers 60% below market rates to pay off existing high interest credit card/personal debt.

Plannery pays off high interest credit cards and personal loans directly to the debtors.

Enroll in payroll deduction to simplify your loan payments.

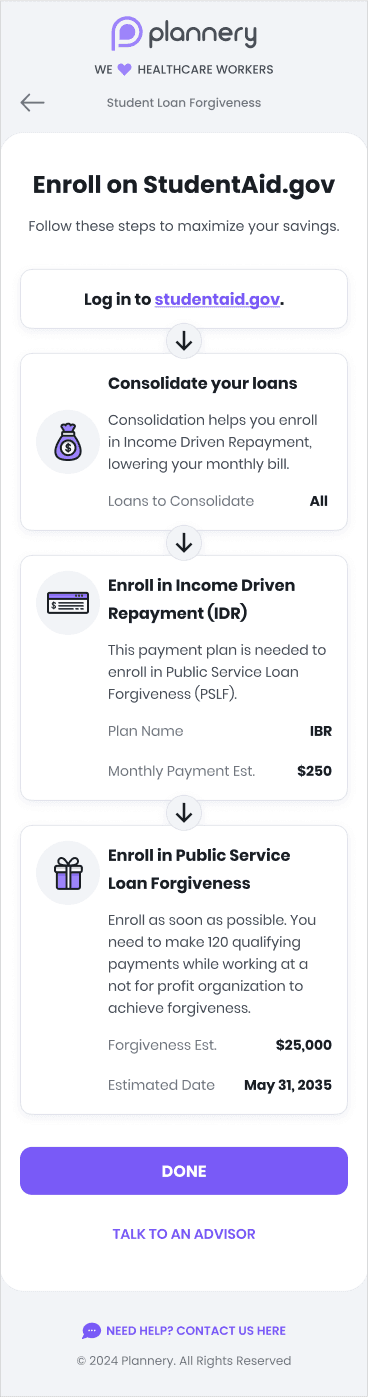

Student Loan

Assistance

Access government assistance and forgiveness, saving on average $64,000.

Receive a personalized enrollment guide.

Free consultation with an advisor, who can also enroll on your behalf.

Get the first card exclusively for employees

Get the first card exclusively for nurses

Up to

Up to

3

3

points per $1 spent

points per $1 spent

points per $1 spent

250

250

points for every student loan payment

points for every student loan payment

points for every student loan payment

Exclusive access and privileges only for employees

Exclusive access and privileges only for employees

Exclusive access and privileges only for employees

80% less interest

compared to other cards

80% less interest

compared to other cards

80% less interest

compared to other cards

AI powered financial companion pays your card

AI powered financial companion pays your card

AI powered financial companion pays your card

Security & Privacy

Your information is always confidential

Plannery employs the latest security standards and practices

Security & Privacy

Your information is always confidential

Plannery employs the latest security standards and practices

Security & Privacy

Your information is always confidential

Plannery employs the latest security standards and practices

Plannery takes care of those who take care of others

Plannery gave me the opportunity to start my debt free journey.

The process was very quick and smooth. I would definitely recommend this company to anyone in healthcare looking to become debt free. Thanks Plannery.

Christie, RN Manager

$258,000 in student loans forgiven

I can't believe the amount I owed is completely forgiven—it's incredible! This opens up amazing financial opportunities for me.

Marc, LMSW

Increased credit score by 110 points

After battling through the financial challenges of COVID-19 pandemic, I found myself shouldering some significant credit card debt. Then I came across Plannery. It has been life changing.

Jason, PA-C

Plannery takes care of those who take care of others

Plannery gave me the opportunity to start my debt free journey.

The process was very quick and smooth. I would definitely recommend this company to anyone in healthcare looking to become debt free. Thanks Plannery.

Christie, RN Manager

$258,000 in student loans forgiven

I can't believe the amount I owed is completely forgiven—it's incredible! This opens up amazing financial opportunities for me.

Marc, LMSW

Increased credit score by 110 points

After battling through the financial challenges of COVID-19 pandemic, I found myself shouldering some significant credit card debt. Then I came across Plannery. It has been life changing.

Jason, PA-C

Plannery takes care of those who take care of others

Plannery gave me the opportunity to start my debt free journey.

The process was very quick and smooth. I would definitely recommend this company to anyone in healthcare looking to become debt free. Thanks Plannery.

Christie, RN Manager

$258,000 in student loans forgiven

I can't believe the amount I owed is completely forgiven—it's incredible! This opens up amazing financial opportunities for me.

Marc, LMSW

Increased credit score by 110 points

After battling through the financial challenges of COVID-19 pandemic, I found myself shouldering some significant credit card debt. Then I came across Plannery. It has been life changing.

Jason, PA-C

We're Here to Help!

Our friendly staff are available to answer questions and guide you through your financial journey.

Call or text

We're Here to Help!

Our friendly staff are available to answer questions and guide you through your financial journey.

Call or text

We're Here to Help!

Our friendly staff are available to answer questions and guide you through your financial journey.

Call or text